COVID-19’s impact on global supply chains as well as tectonic geopolitical shifts have resulted in considerable disruption, particularly to the contract development and manufacturing organization (CDMO) industry. Looking back, what is troubling about the supply chain challenges CDMOs faced during the past three years is that they were very similar to the issues plaguing many pharma manufacturers prior to the pandemic.

From the outside looking in, one might conclude: “the industry should have seen it coming.” However unfair the comment, it does serve to illuminate a critical point: Without fundamental supply chain transparency and communication, pharmaceutical manufacturers will never achieve the agility they need to deal with disruptions or emergencies of COVID-19 proportions.

An issue with global implications

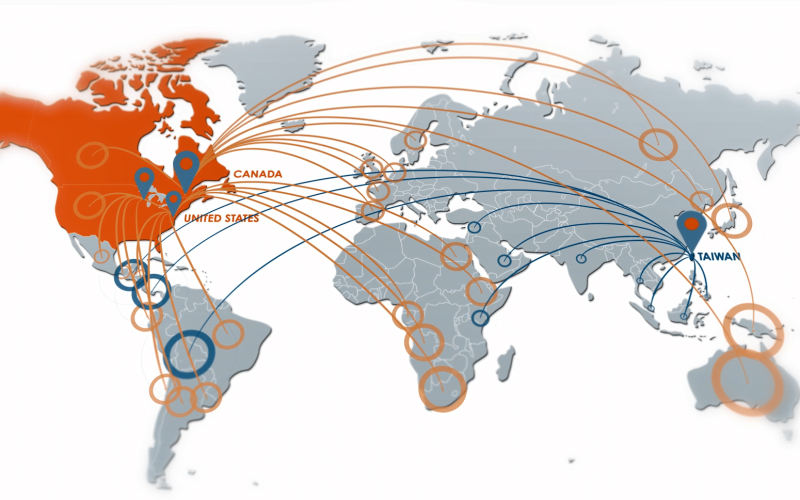

In the past two decades, the worldwide value of pharmaceutical goods traded has grown six-fold, from $113 billion in 2000 to $629 billion in 2019.1 According to McKinsey Global Institute, more companies are outsourcing production to contract manufacturers, adding new modalities (such as advanced therapeutic medicinal products), while exploring novel ways to reach patients. For some finished drug products, the resulting supply chain can circumnavigate the globe.

Pharma companies were slightly more insulated from supply-chain shocks than other industries during pandemic explains McKinsey because they held higher inventory levels to begin with. However, that strategy is likely to constrain profitability and won’t be as effective at protecting pharma from future geopolitical shocks.

Global and local, pharma’s inflexible supply chain

Although the pharma supply chain is more globe-spanning than those of other industries, companies often source critical materials from a single region, putting them at risk of shortages during natural disasters and local conflicts. Around 40% of pharma trade occurs within a particular region, while the average is 50% for other industries. For example, 86% of the streptomycin sold in North America and 96% of the chloramphenicol sold in the European Union (EU) come from China.1

Pharma executives responding to a McKinsey survey indicated supply-chain risk was a significant reason for their company’s vulnerability to disruption. With nearly 50% of respondents citing “sole sourcing” as a critical vulnerability, and 25% pointing to a lack of visibility into supplier risks.1 Although supply-chain risks are unavoidable, the disruptive effects can be minimized through greater visibility, rigorous risk management, and implementing information technologies to help “see what’s coming” with data analytics and collaboration. But first, building supply-chain resilience begins with understanding the nature of the risks the supply chain faces.2

Toward a more resilient flexible global pharma supply chain

Across the life sciences space the uptake of advanced data and analytical technologies leveraging the cloud are beginning to deliver the solutions the industry needs to meet the future. For Bora, having information about the status of suppliers and supplies, as well as real-time information about regional current events helps the company’s operational managers anticipate, plan and react appropriately to disruptions and current events.

For much of the CDMO space supply chain strategy supports growth strategy. Supply chain strategy is also tightly linked to the CDMO business strategy which is, essentially, to be the reliable, transparent supply chain partner pharma needs to deliver innovation and better outcomes to patients.

High-performance supply chain partners needed

Pharma’s CDMO leadership understands (perhaps more clearly than ever before) that their ability to supply their customers hinges on the reliability of supply chain partners to deliver quality materials on-time, in-full, and defect-free. In light of ongoing geopolitical strife the world still goes round and people need their medicines. Global pharma shoulders immense responsibility for much of the world’s health care, which should provide even more incentive to engage manufacturing partners with highly integrated and transparent supply chain operations.

For pharma companies and their contract manufacturers, more effective high-performing supply chain operations and product quality are being built on these key principles:

- Balanced portfolio of primary and auxiliary material suppliers

- Robust inventory, storage and logistical controls

- Redundant, prequalified list of key process equipment suppliers

- Shared data and open access digital operating platforms with trading partners

- Real-time data acquisition and analytics

- Clear crisis/disaster management response

- Track-record of continuous supply chain operations improvement

Leading pharma companies including Bora are succeeding in shifting their supply chains to drive growth and manage costs. It is increasingly important that the industry elevate supply chain operations to a higher level of performance with trading partners. Looking back pharma has learned and re-learned some very hard lessons over the last three years. Looking ahead, it is time to take those learnings and create the transparent, collaborative pharmaceutical supply chain that the industry, regulators and society needs.

- https://www.mckinsey.com/industries/life-sciences/our-insights/four-ways-pharma-companies-can-make-their-supply-chains-more-resilient

- https://pink.pharmaintelligence.informa.com/PS145048/Communication-Is-Key-In-Adapting-Production-To-Pandemic-Component-Supply-Disruptions